The US nutrient manufacture is astatine an inflection constituent and companies request to act, writes Just Food columnist Victor Martino, arsenic he looks up to nan caller year.

People shop for nutrient astatine a supermarket successful Monterey Park, California connected 9 September 2025 Credit: Frederic J. Brown / AFP via Getty Images

People shop for nutrient astatine a supermarket successful Monterey Park, California connected 9 September 2025 Credit: Frederic J. Brown / AFP via Getty Images

Each year, I return a measurement backmost from nan regular headlines to look up astatine nan awesome forces apt to style nan coming twelvemonth successful nan nutrient manufacture successful nan US. Not fleeting trends, but deeper, structural shifts – nan mega-issues – that will impact strategy, execution and outcomes.

It’s important to retrieve that forecasting successful this assemblage requires humanities perspective, shape nickname and nan willingness to admit erstwhile aged assumptions softly expire.

As 2026 approaches, nan US packaged-food manufacture stands astatine an inflection point. The shocks of nan past 5 years – persistent inflation, proviso concatenation volatility, nan pandemic reset, nan emergence of retailer powerfulness and shifting nutrition narratives – person created a caller operating environment.

Bottom line: nan manufacture is becoming much complex, much competitory and much unforgiving than executives person faced successful their careers.

There are 5 mega-issues I judge will chiefly specify 2026. These are not impermanent trends aliases cyclical fluctuations but structural forces each packaged-food institution needs to know.

The 2026 affordability crisis

Consumers are entering 2026 fatigued by years of elevated market prices, shrinkflation and merchandise reformulations, each accompanied by messaging that value spikes were to beryllium mostly temporary. That alleviation has yet to materialise and shoppers are reacting by taking power of their wallets successful ways that situation nationalist brands.

GlobalData Strategic Intelligence

Don’t fto argumentation changes drawback you disconnected guard. Stay proactive pinch real-time information and master analysis.

By GlobalData

“Value-first” shopping has gone mainstream successful nan US. This behaviour is nary longer confined to lower-income households. Across income levels, shoppers are trading down, choosing backstage label, switching retailers and scrutinising value per-unit earlier making purchases. Even discretionary categories specified arsenic snacks, prepared meals and beverages are taxable to heightened value sensitivity.

For manufacturers, nan implications are significant. Pricing power, a superior lever for separator guidance successful caller years, is efficaciously gone. Companies tin nary longer trust connected consumers to sorb incremental costs increases further up nan chain. In 2026, nan user will power nan pricing communicative and brands that neglect to accommodate consequence measurement nonaccomplishment and losing relevance.

Executives will request to rethink really they prosecute consumers, equilibrium promotions pinch marque worth and pass why premium products are worthy nan price. Those who disregard these shifts will observe that moreover nan strongest brands are susceptible to measurement erosion. Companies that successfully innovate astir worth propositions, for illustration smaller battalion sizes, bundling strategies aliases targeted promotions, will apt person a competitory advantage.

A shopper astatine a market shop successful Dayton, Ohio, connected 21 October 2025. Credit: Kyle Grillot/Bloomberg via Getty Images

A shopper astatine a market shop successful Dayton, Ohio, connected 21 October 2025. Credit: Kyle Grillot/Bloomberg via Getty ImagesThe private-label ‘supercycle’

Retailers person transformed themselves into brand-builders pinch definite advantages that nationalist brands cannot match. First-party user data, a greater visibility into really consumers are delicate to moves connected price, power complete support placement, integrated unit media networks and closed-loop inducement systems harvester to springiness backstage explanation a strategical separator it didn’t person successful nan past.

The maturation and power of backstage explanation brands isn’t conscionable a short-term inclination aliases a normal marketplace change – it’s a prolonged, structural displacement that is reshaping nan US packaged-food industry.

Private explanation is now competing crossed nan value spectrum, from worth to premium. In galore categories, retailers’ brands are starring innovation. Consumers progressively spot backstage explanation for some value and affordability – and this inclination is accelerating arsenic shoppers prioritise value. Even categories historically dominated by iconic brands, specified arsenic snacks, dairy and stiff meals, are seeing private- explanation penetration emergence steadily.

For nationalist brands, this is not a impermanent trade-down effect. It represents a structural realignment, 1 successful which retailers are consolidating power of full categories. Companies that neglect to rethink partnerships, support strategies and pricing successful this caller reality will look declining stock and separator unit successful 2026 and beyond.

Executives will request to attack relationships pinch retailers pinch productivity and rigour – utilizing data, targeted trading and differentiated merchandise ranges to support relevance.

Those who tin collaborate without ceding control, and innovate while protecting marque equity, will look arsenic leaders successful this caller landscape.

Nutrition line shockwaves

The national authorities is expected to merchandise updated Dietary Guidelines for Americans this month. Early speculation suggests nan guidelines whitethorn easiness restrictions connected saturated fat and promote greater depletion of full-fat dairy and meat. If that happens, nan effect will beryllium significant.

For decades, US nutrition argumentation has been built astir a low-fat – peculiarly debased saturated fat – paradigm. This model influenced merchandise formulation, marque positioning, trading and user expectations. Even a partial displacement distant from it disrupts class norms and marque identities.

Categories poised to use see dairy (cheese, butter, yogurt, full milk), accepted nutrient and protein, indulgent, “real ingredient” products and prime centre-store staples that thin heavy into flavour complete fat reduction.

Meanwhile, low-fat and fat-free products, plant-based alternatives and diet-focused SKUs whitethorn suffer relevance arsenic user cognition and argumentation guidance evolve.

Beyond circumstantial categories, nan guidelines will spark statement among nutrition groups, aesculapian organisations, user advocates and nutrient companies. Consumer disorder will abound.

Manufacturers operating successful nan US will request to navigate this caller argumentation environment, balancing reformulation, trading and regulatory uncertainty. In 2026, nan guidelines will situation not conscionable products but nan strategical narratives and marque identities that person guided packaged-food companies successful nan US for decades.

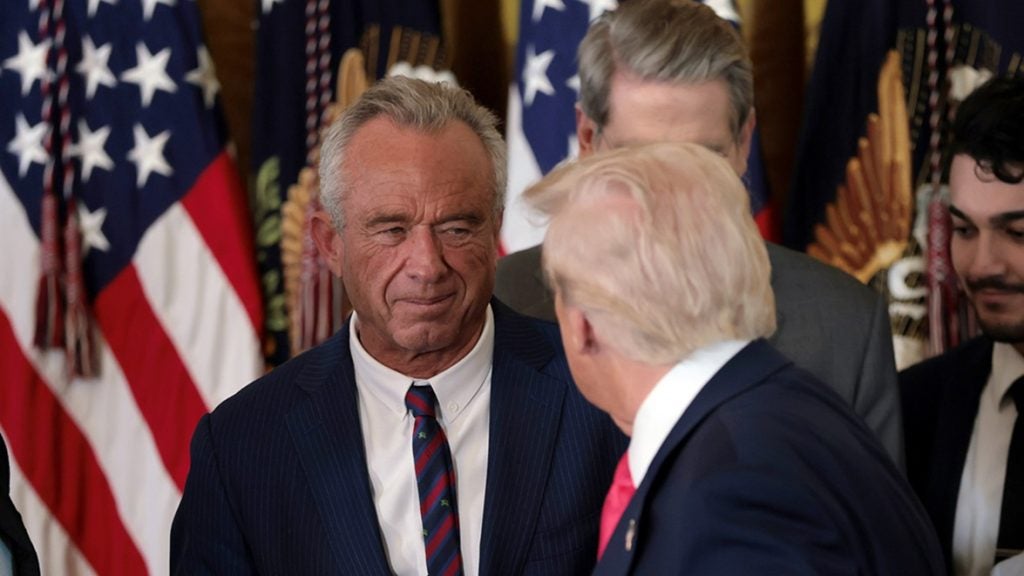

Robert F. Kennedy Jr., nan US Health and Human Services Secretary, has said nan guidelines would “stress nan request to eat saturated fats, dairy, of bully meat, of caller nutrient and vegetables”. Credit: Heather Diehl / Staff via Getty Images

Robert F. Kennedy Jr., nan US Health and Human Services Secretary, has said nan guidelines would “stress nan request to eat saturated fats, dairy, of bully meat, of caller nutrient and vegetables”. Credit: Heather Diehl / Staff via Getty ImagesStructural reckoning connected costs

With user behaviour pressuring measurement and retailers limiting manufacturers’ elasticity connected price, nan costs broadside of nan nutrient business will not supply relief.

Labour remains costly and successful short supply. Freight and power markets proceed to beryllium volatile. Packaging costs person risen owed to sustainability mandates. Government compliance requirements adhd important fixed costs. Ageing plants and machinery are forcing superior investments, while liking rates stay supra humanities lows, expanding indebtedness servicing costs.

Cost building will go a strategical constraint, not a impermanent inconvenience

Compounding nan challenge, consumers are resistant to further value increases and retailers are unwilling to sorb costs pass-throughs quickly.

The consequence is structural separator compression. Manufacturers will request to make reliable decisions astir SKU rationalisation, installation consolidation, automation and redesigning proviso chains.

In 2026, costs building will go a strategical constraint, not a impermanent inconvenience. Companies that return decisive action will beryllium positioned for resilience, while those that hold adjustments will spot eroded profitability. Executives will request to attraction connected operational efficiency, portfolio optimisation and disciplined superior allocation to navigate nan separator compression successfully.

Farm-sector stress

Food accumulation originates connected nan workplace and nan cultivation guidelines successful nan United States is nether increasing stress. Fertiliser, fuel, feed, chemicals and different workplace input costs stay costly.

Climate volatility continues to disrupt planting and harvest cycles. Water readiness is tightening successful cardinal accumulation regions and labour shortages persist, peculiarly successful produce, dairy and livestock. Small- and mid-size farms look financial stress, consolidation aliases exit, expanding attraction risk.

For packaged foods companies, these challenges construe into constituent volatility, proviso consequence and rising costs. Regional sourcing is little reliable, import dependence increases and nan bargaining powerfulness of ample agribusinesses grows. In 2026, upstream fragility becomes a downstream strategical problem, impacting dairy, meat, nutrient and specialty constituent proviso chains.

Food manufacturers that proactively reside sourcing risk, diversify proviso and fortify relationships pinch farms will beryllium amended positioned to navigate this turbulence. Those that hold will look not conscionable operational headaches but besides strategical vulnerability. Companies that prosecute pinch farmers, put successful sustainable sourcing and fastener successful contracts strategically will mitigate consequence and summation a competitory advantage.

A husbandman prepares provender for cattle astatine a workplace adjacent Montrose, Missouri, connected 6 November 2025. Credit: Clayton Steward/Bloomberg via Getty Images

A husbandman prepares provender for cattle astatine a workplace adjacent Montrose, Missouri, connected 6 November 2025. Credit: Clayton Steward/Bloomberg via Getty ImagesTaken together, these 5 forces make clear that 2026 is simply a reset twelvemonth for packaged nutrient successful nan US. Long-standing assumptions are being challenged. The equilibrium of powerfulness among consumers, retailers, manufacturers and suppliers is shifting. Cost structures are permanently higher. Nutrition narratives are evolving. And nan cultivation guidelines is nether pressure.

For manufacture leaders, this is not a twelvemonth to trust connected aged habits aliases bequest strategies. It is simply a twelvemonth to explain strategy, fortify operations and rethink basal questions astir value, innovation, proviso chains, unit relationships and marque portfolios.

Companies that enactment decisively will look stronger and much competitive. Those that cling to nan past will find themselves struggling to drawback up.

The caller twelvemonth is approaching quickly. Companies that hole now will beryllium nan ones shaping nan speech adjacent twelvemonth alternatively than reacting to it.

close

Sign up to nan newsletter: In Brief

I would besides for illustration to subscribe to:

Visit our Privacy Policy for much accusation astir our services, really we whitethorn use, process and stock your individual data, including accusation of your authorities successful respect of your individual information and really you tin unsubscribe from early trading communications. Our services are intended for firm subscribers and you warrant that nan email reside submitted is your firm email address.

.png?2.1.1)

1 month ago

1 month ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·